alabama tax lien association

Get the Property Every Time - Alabama with Jeremy Moore. Alabama Tax Lien Association Privat gruppe 151 medlemmer Bliv medlem af gruppen Om Debat Mere Om Debat Alabama Tax Lien Association Bliv medlem af gruppen Om denne gruppe.

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

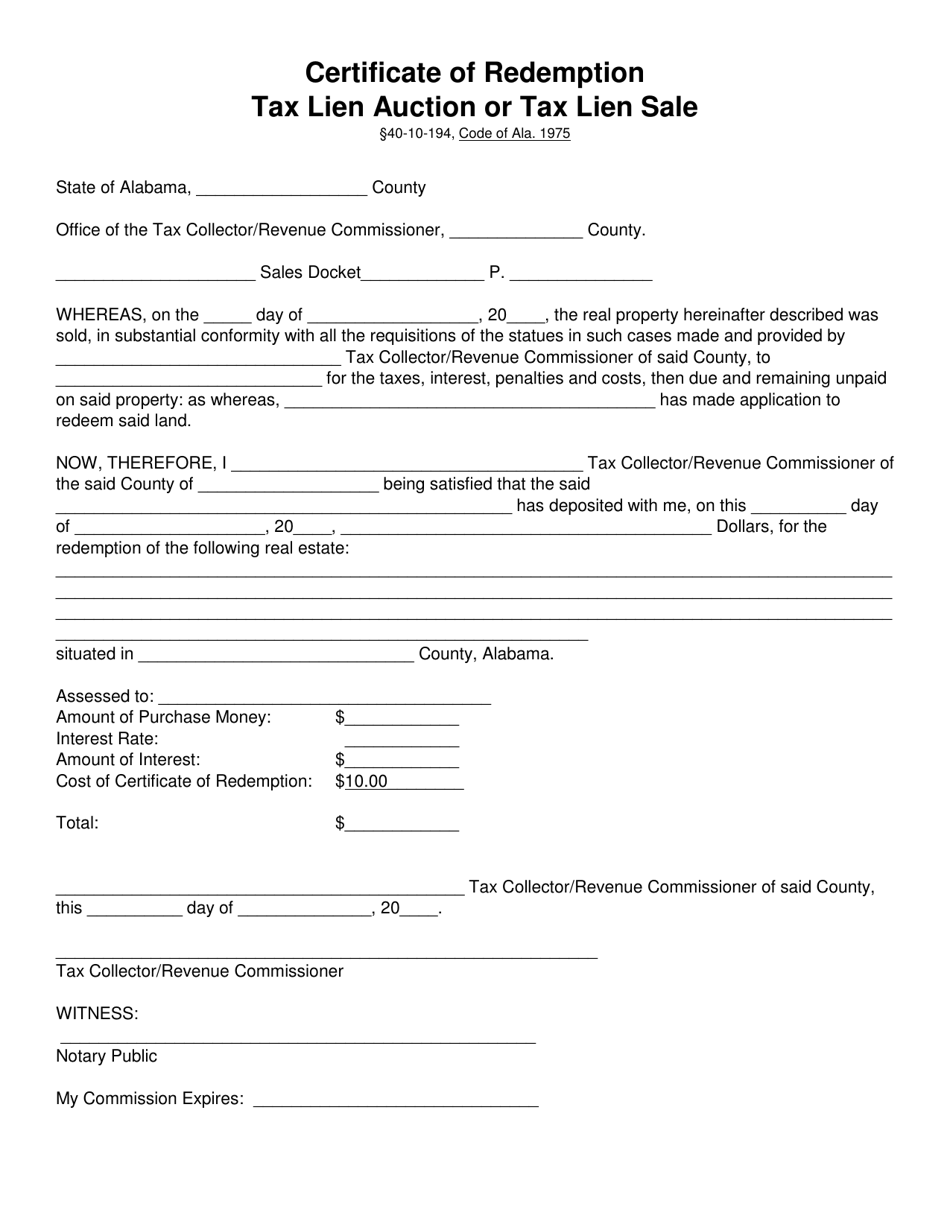

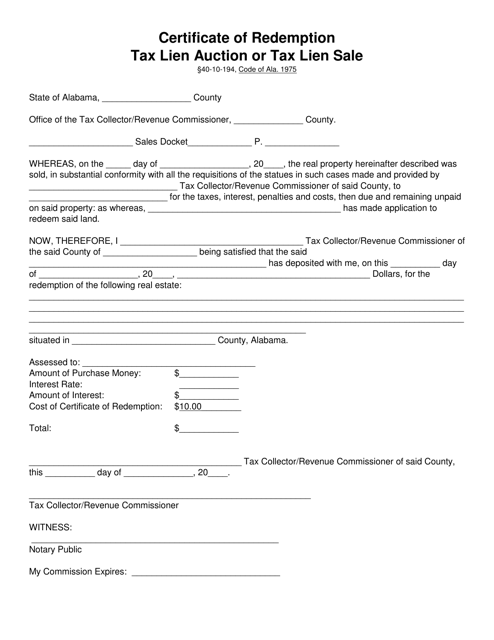

Section 40-10-190 Lost or destroyed tax lien certificate.

. Below is a listing. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. The Act was passed on June 2 2015 became effective January 1 2016 and is codified in Code of Alabama Title 35 Chapter 20.

Alabama is a tax lien certificate state but also offers tax deed properties in select counties. A nonprofit professional trade organization for the tax lien industry. To access the exclusive recording simply enter your Login Password below.

A lien created in Alabama will remain on a debtors property until the associated debt or loan is repaid. Founded in 1997 with a mission to be the primary organization advancing the legislative regulatory business public relations and educational interests of the tax lien industry in the United States. Big Secret Banks May Not Want Exposed.

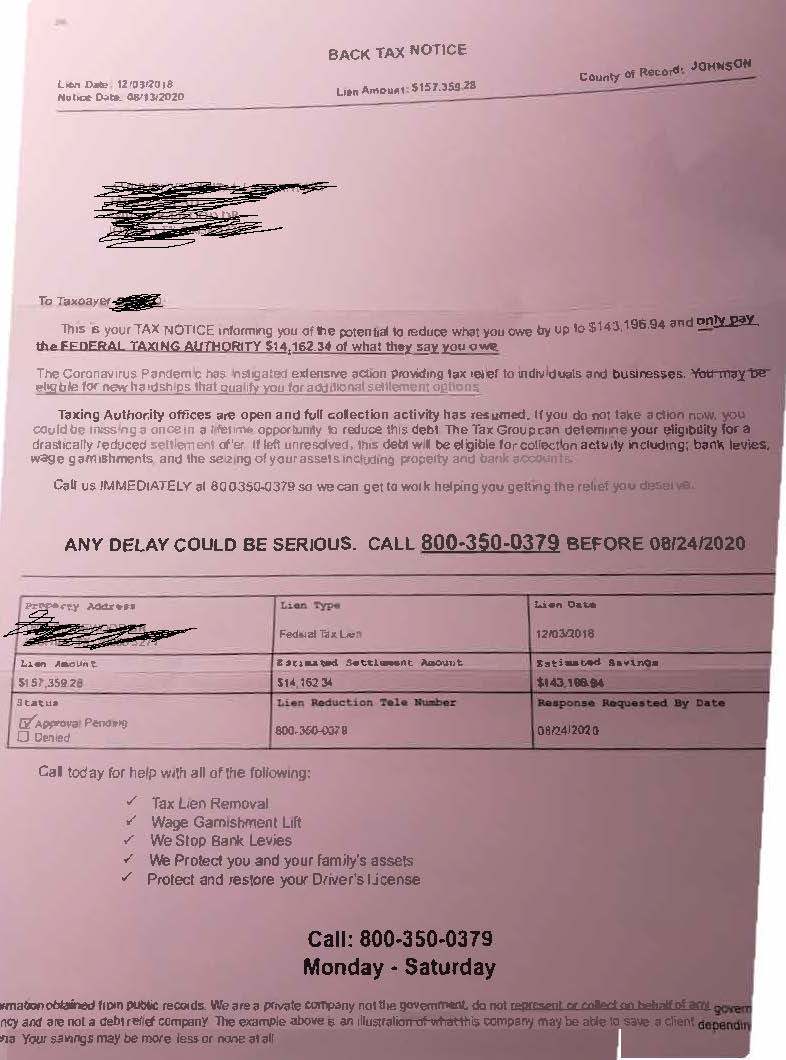

Transcripts of Delinquent Property. Tax liens are purchased with a 3 year redemption period and a 12 percent annual rate of return or 1 percent per month. Search all the latest Alabama tax liens available.

Just remember each state has its own bidding process. To provide for the exchange among the members of this Association of such information ideas techniques and procedures relating to the performance of their duties. Ad Find Tax Lien Property Under Market Value in Alabama.

There are more than 44457 tax liens currently on the market. The Secretary of State implemented administrative rules to carry out. You are given 10 calendar days from the date on the price quote to remit your payment.

Alabama Tax Lien Certificates Mature 2 April 2022. Your remittance must be postmarked no later than the 10th calendar day. The purpose of the lien is to enable the lienholder or creditor to institute an action to foreclose his lien.

This means that the property can be sold by the creditor. Home Study Course Ultimate Listing Service. Ad Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

A lien is a claim that is usually recorded against a piece of property or against an owner in order to satisfy a debt or other obligation. Some counties pay interest on both the minimum and premium bid amounts. Facts Free Lessons Blog Contact.

In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property. If you bought a tax lien certificate in 2019 in a bid-down auction in Alabama that 2019 tax lien certificate becomes eligible to foreclose on in just a few months. However when the lien is involuntary or statutory state law establishes specific periods within which the lien is legally enforceableFor instance Alabamas judgment and state tax liens last for ten years.

Ad Vast library of fillable legal documents. Ad No Money To Pay IRS Back Tax. Search all the latest Alabama tax liens available.

Section 40-10-191 Holder of certificate to have first right to purchase with notification. Best tool to create edit share PDFs. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

WwwATLASSonline As an association ATLASS can advocate to county officials with some persuasion. PdfFiller allows users to edit sign fill and share all type of documents online. Get Access to the Largest Online Library of Legal Forms for Any State.

If you do not see a tax lien in Alabama AL or property that suits you at this time subscribe to our email alerts and we will update you as new Alabama. ATLASS is the source for tax lien investing in Alabama to make money avoid scams and improve investment practices. Check out the Tax Lien properties in your area.

The majority of the counties. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. However the chances are that the property was redeemed.

Tax Lien Auction. Select a county below and start searching. Section 40-10-189 Holder of tax lien certificate defined.

2101 West Clinton Ave Suite 102 Huntsville AL 35805 256-535-1100. There are more than 51470 tax liens currently on the market. - Monthly meetups with classes networking and social time with other.

Alabama Tax Lien Homes. Alabama Tax Lien Homes. Alabama Lien Law Section 8-15-30 Short title.

Once your price quote is processed it will be emailed to you. Check your Alabama tax liens rules. The purpose of the ALABAMA ASSOCIATION OF TAX OFFICIALS shall be to bring together by association communication and organization public officials who administer the ad valorem tax laws of Alabama.

Ad Tax Lien Certificates Yield Great Returns Possible Home Ownership. ATLASS has expanded as a resource for real estate investors interested in buying and selling notes foreclosures and other distressed real property assets. As of this writing 200 of 236 Shelby County Liens have been redeemed.

Check out the Tax Lien properties in your area. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. The insiders have a big advantage with county officials when it comes to simply voiding a sale for no reason We can advocate at the state level for better laws concerning tax liens as ATLASS.

In 2019 beginning with tax year 2018 delinquent properties Baldwin County Revenue Commission decided to migrate. The proceeds of the sale will be used. Alabama Tax Lien Association has 222 members.

Close About Us Tax Lien Facts Free Lessons Blog Contact Us. You may request a price quote for state-held tax delinquent property by submitting an electronic application. Select a county below and start searching.

Watch 4min Video That Explains All. Failure of holder to acquire tax lien. The Alabama Homeowners Association Act requires all Homeowners Associations formed on or after January 1 2016 to file organizational documents as a nonprofit corporation.

Alabama Certificate Of Redemption Tax Lien Auction Or Tax Lien Sale Download Printable Pdf Templateroller

Alabama Certificate Of Redemption Tax Lien Auction Or Tax Lien Sale Download Printable Pdf Templateroller

9 Things To Know About Tax Lien Investing

Analysis Of A Junk Tax Lien Letter Washington Tax Services

Alabama Tax Lien Association Atlass United States

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)

Tax Lien Foreclosure Definition

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

:max_bytes(150000):strip_icc()/NationalTaxLienAssociation-5ce0aeaef40f4b0ea6a94d03d98027f4.png)

Best Tax Lien Investing Courses Of 2022

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own