virginia estimated tax payments due dates 2021

Virginia 2020 individual returns are now due May 17. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021.

Virginia Sales Tax Guide And Calculator 2022 Taxjar

October 27 2020 October 27 2020 Leave a Comment.

. First quarter 2021 estimated tax payments are still due may 1. Individual Income Tax Filing Due Dates. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter.

If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the estimated tax payment that would normally be due on January 15. Virginia estimated tax due dates 2021. Savings.

West Virginia Code 16A-9-1d Sales and Use Tax. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. Virginia estimated tax payments due dates 2021.

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS 2022 FOR INDIVIDUALS FORM 760ES Form 760ES Vouchers and Instructions wwwtaxvirginiagov Effective for payments made on. Returns are due the 15th day of the 4th month after the close of your fiscal. Estimated income tax payments must be made in full on or before May 1 2022 or in.

First quarter 2021 estimated tax payments are still due May 1. Any installment payment of estimated tax exceeds 2500 or Any payment made for an extension of time to file exceeds. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15.

11 2021 and up to june 15 2021 can now be paid on or before june 15 2021. Maryland taxpayers get a break. Maryland announced an extension of time to file and pay 2020 individual pass-through fiduciary and corporate income taxes with due dates between Jan.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. The blue house petition. Virginia estimated tax payments due dates 2021.

Due dates for 2021 estimated tax payments. 1 2021 and July. Daihatsu fourtrak for sale northern ireland Área do Aluno.

Virginia estimated tax payments due dates 2021. Like the IRS Virginia is NOT giving a break to individual taxpayers who need to pay 2021 estimated tax payments. Please enter your payment details below.

Please enter your payment details below. Typically most people must file their tax return by May 1. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2022.

West Virginia Code 16A-9-1d Sales and Use Tax. Individual Estimated Tax Payments - Virginia. Set up or log in securely at.

If the ending month for the taxable year of the corporation is March 2021. Which the estimated payment is made not the ending date for the quarter the estimated payment is made. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter.

Make final estimated tax payments for 2021 by Tuesday January 18 2022 to help avoid a possible assessment for taxes owed and penalties. 15 de dezembro de. Virginia estimated tax payments due dates 2021.

2020 Maryland individual returns and the first two 2021 quarterly estimated payments are due July. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments.

Cemeteries In Charlotte County Virginia Find A Grave County Instagram Tutorial Virginia

1099 G 1099 Ints Now Available Virginia Tax

Virginia Sales Tax Small Business Guide Truic

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Pay Online Chesterfield County Va

Instructions On How To Prepare Your Virginia Tax Return Amendment

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

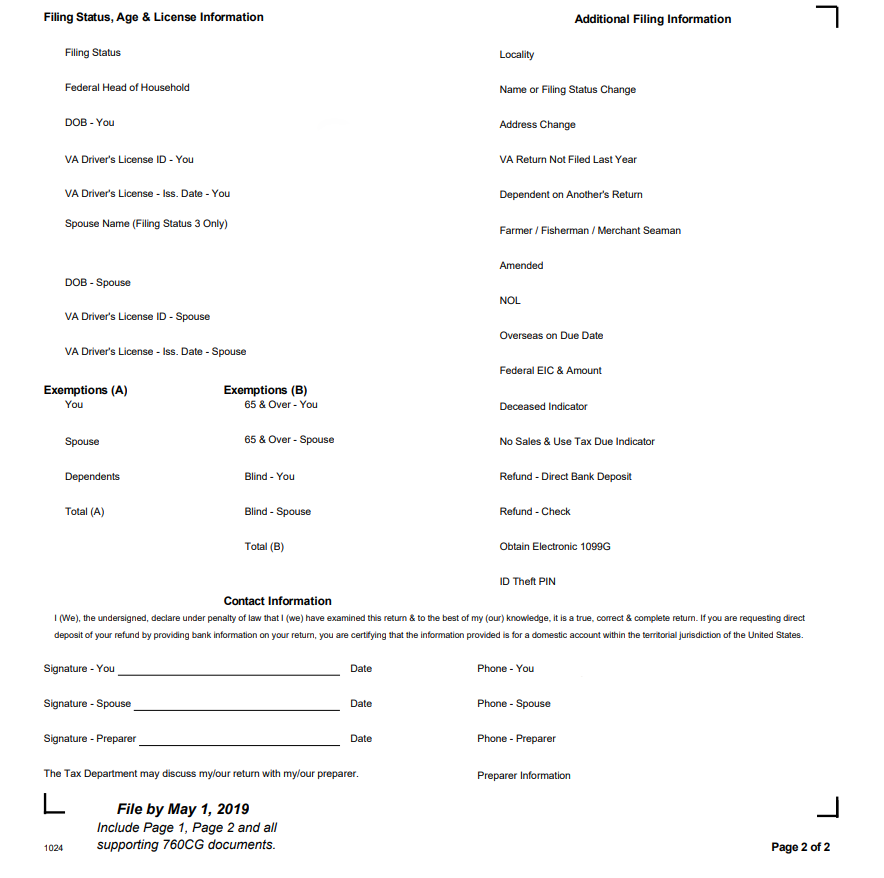

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Where S My Refund West Virginia H R Block

Pay Online Chesterfield County Va

Virginia Dpb Frequently Asked Questions

Virginia State Taxes 2022 Tax Season Forbes Advisor

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

This Quarterly Tax Reference Guide Is For Any Business That Has Employees And Contrac In 2021 Bookkeeping Business Small Business Bookkeeping Small Business Accounting

Real Estate Tax Frequently Asked Questions Tax Administration

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax